Our Campaign

Help Deprived Pensioners

“Deprived Pensioners” are pensioners who had inflation indexation in their company schemes but have been deprived of it by the PPF system.

This means their pensions don’t increase with inflation, which at this desperate time of rising prices and energy costs, puts them at risk of serious financial hardship.

The Deprived Pensioners are members of the Pension Protection Fund. The Fund makes compensation payments to people who were in defined benefit pension schemes where the company went bust leaving the scheme unfunded. The PPF was set up under the Pensions Act 2004 which, due to Government oversight, included the clause: ‘pensionable service prior to April 1997 shall not give entitlement to indexation’.

Parliament’s role in creating this injustice

Hansard’s record of the second reading debate on the 2004 Act (25 February 2004) offers compelling evidence that neither the Secretary of State who introduced the Act, nor any of the MPs who debated it, were aware of the existence of the pre-1997 rule.

It seems to have been a case of legislation by ignorance. The pre-1997 rule is a disgrace in its own right, but the government have a particular obligation to overturn it if it can be seen to be a product of ignorance. This astonishing situation might be explained by the fact that this rule is not in the Act itself, lengthy though it be, but in the seventh of the detailed Schedules appended to the Act. But that is no justification for the discrimination now being suffered.

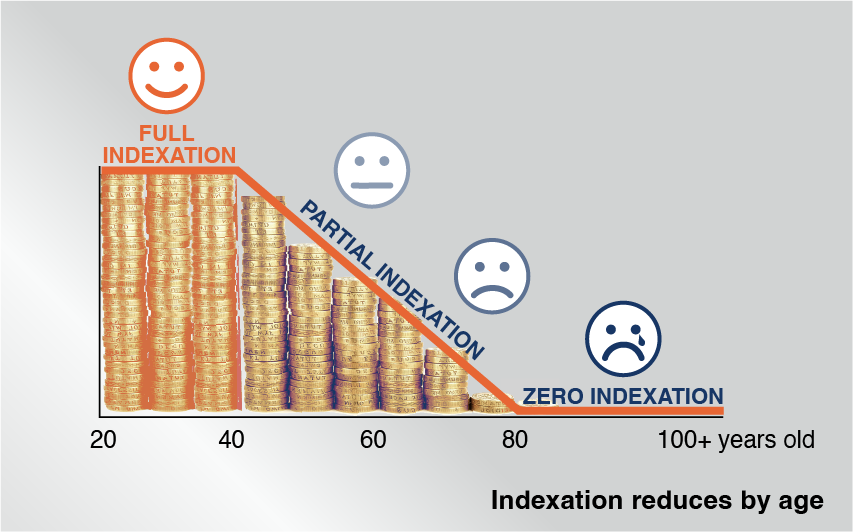

The outcome is that long-serving people aged below 40 will get FULL indexation (subject to cap). People aged 40-80 PARTIAL indexation. Indexation reduces with age. Those over 80 get ZERO indexation.

"This is a deplorable and absolutely clear case of age discrimination. This is at a time of excessive PPF surplus", an issue raised at Committee by Lord Davies of Brixton, April 2, 2023

Duty of Care

The Pension Protection Fund has a Duty of Care towards its members. Simply stated, this means that they should not allow anything to happen which might foreseeably cause damage to those members. Damage to members caused by the pre-1997 rule will not only foreseeably cause damage: it is causing damage now and has done so for many years past. The Fund has an obligation to its members to do whatever it can to work towards the removal of the damaging clause. At the least, they should be lobbying government to amend the law

OUR AIM IS TO AMEND THIS LAW TO BENEFIT ALL PPF AND FAS MEMBERS

Help from the PPF or Dept for Work & Pensions? No!

We raised this issue with the PPF at the highest level.

Their argument is that they are delivering to the letter of the law: therefore they refuse to see a problem. This belief was clearly stated by Sara Protheroe, Chief Customer Officer and Board member, at a Forum meeting between senior PPF staff and PPF members on 10 October 22. Without a change in the law, the PPF will resist all attempts to reinstate the missing indexation.

Representations have been made to the Department for Work and Pensions.

They simply restate the detail in the law. We know what the law is: we want it changed. The Department of Work and Pensions has never given a considered justification of the pernicious pre-1997 rule.

Guy Opperman MP, Minister for Pensions and Financial Inclusion, in a letter to Cherilyn Mackrory MP, 13 July 22: “The Government believes that a balance has been struck between the interests of members of underfunded schemes and those who help to support the Fund by means of the PPF levy.”

No analysis, just a “belief” – he wholly fails to address the issue, which is the unfair treatment between different categories of PPF members. Is it not ironic that it is the Minister for Financial Inclusion who is defending the exclusion of elderly people from receipt of indexation!?

Our only option:

change the law

We have appointed long-established solicitors, Edwin Coe LLP, the leading firm for class action litigation.

The DPA is working to bring an action for Judicial Review to get the law changed. For this we are working to raise £75,000. We aim to raise this money by a social media campaign, with the help of a fundraising platform: CrowdJustice. Money transfers are by Stripe, regulated in the UK by the Financial Conduct Authority. Donations received by Crowdjustice are transferred to a trust fund held by Edwin Coe, from which the costs of fighting the case will be met. This money is never held by DPA

Voices calling for change

Parliament and the Press are slowly waking up to this crisis ...

UK Parliament

Public Accounts Committee

AEA Technology Pension Case

This is a House of Commons Committee report, with recommendations to government. The Government has two months to respond.

Fifty-Seventh Report of Session 2022–23

“Recommendation 1: The government should review whether the current rules for increasing PPF compensation for inflation are appropriate. This should consider the costs and benefits of extending the rules so that benefits accrued before April 1997 are also increased for inflation and, separately, of raising the cap for annual increases above 2.5%.”

Work and Pensions Select Committee

This committee is currently considering defined benefit pensions, including the working of the Pension Protection Fund. DPA has been lobbying strongly against the pre-1997 clause. We have sent two written submissions and, on 8th November, Roger Sainsbury gave oral evidence on behalf of DPA/ You can see this session if you go to

https://www.parliamentlive.tv/Commons and then to Archive and Committees.

The argument is being won. In the succeeding session of the Select Committee, Oliver Morley, the outgoing CEO of the PPF emphasised that the Fund is constrained in what it can do by the pre-1997 Clause. He said, however, "I think there is a good case, on equity grounds, around pre-1997 (indexations)".

Grand Committee

Lord Davies of Brixton raised this issue at Grand Committee.

Pension Protection Fund and Occupational Pension Schemes (Levy Ceiling) (No. 2) Order 2023.

Volume 829: debated on Wednesday 26 April 2023

“In practice, the majority of pre-1997 scheme members were either accruing benefits to which they were entitled through RPI increases, typically capped at 5%, or were in the many schemes funded on the basis that such increases were going to be provided and members had a reasonable expectation of receiving them. In other words, such increases were part and parcel of the package of scheme benefits, and their effective exclusion from protection must be open to legal challenge. Such a challenge becomes more likely as higher rates of inflation persist. So we should, first, provide higher rates of protection to better reflect modern rates of inflation and, secondly, eliminate the arbitrary and unfair difference in treatment for compensation in respect of pre-1997 and post-1997 service.”

Press

Pension lifeboat fund rules leave 83,000 with no cover for rising UK inflation

Ministers urged to review PPF policy for elderly members exposed to cost of living crisis

Financial Times, Josephine Cumbo, 16 May 2022

“Ministers are being urged to review “grossly unfair” compensation arrangements affecting 83,000 elderly members of the UK’s pension lifeboat fund as the cost of living soars. The Pension Protection Fund said it had received complaints from members over the lack of inflation protection on their retirement benefits as energy and food bills skyrocket.”

Retirees with cursed company pensions lose £75m to inflation

200,000 Britons will have payouts capped despite rocketing inflation

Telegraph, Jessica Beard, 14 June 2022

“Hundreds of thousands of pensioners in the PPF will be more than £75m worse off in real terms, and will have little to no protection against rising prices. … More than 83,000 elderly members will be dealt the hardest blow, as those with pensionable service before April 1997 won’t see any increase in their PPF benefits and so are especially vulnerable.”

FAS members still waiting for pensions justice

The danger of losing indexation

Terry Monk, Pensions Expert publication, March 24, 2023 Terry Monk is a member of the Pensions Action Group, a former director of ITS, and a former member of the Bradstock Group Scheme, which transferred into the FAS in 2013

“This example is of an anonymous ASW member who reached normal retirement date in 2004, with an expected pension of £15,013 a year with up to 5 per cent a year retail price index indexation on the whole amount. Once they had been admitted into the FAS, their award was just 90 per cent of this – £13,512 a year – with a maximum 2.5 per cent a year consumer price index indexation on post-1997 pensionable service (seven years), and zero per cent indexation of pre-1997 pensionable service (25 years). If all service inflation protection was calculated at the original scheme rate using RPI and CPI – the DWP switched to CPI in 2004 in order “to simplify calculations across government” – the member’s pension would now be £29,581. The annual loss to this member is £16,069, or 54 per cent, and is increasing every year.

For some reason that has never been satisfactorily explained to the PAG, the guaranteed minimum pension increases from being contracted out between 1988 and 1997 have also been lost in both the FAS and the PPF.”

Next steps ...

Origin of the indexation problem

Unless you are already well briefed on this subject, you might be baffled as to how the pre-1997 clause found its way into the legislation. The “Second Reading debate” explains this error.

Its origins reach back to 1997, when it became mandatory for defined benefit schemes to include indexation. Perhaps a naïve assumption was made that, prior to its becoming mandatory, no company schemes provided indexation. However, this is incorrect. The PPF reported that, prior to its becoming mandatory, 60% of company schemes had indexation. Source: letter from Sara Protheroe, Chief Customer Officer Pension Protection Fund, 9 February 2023.

There is no evidence that any thought was given to the issue at all. The Act should have required that the PPF respected the original indexation offering. Those whose company schemes included indexation should be granted indexation; those whose schemes did not should not. Not difficult. Failure to make this provision is the root of the present injustice.

A broken promise approved in ignorance

Hansard records the lengthy second reading debate on 2nd March 2004. The Secretary of State, Andrew Smith, opening the debate, said:

“I am clear that a pensions promise made should be a pensions promise honoured. That is why, for the first time ever, we will set up the pension protection fund to protect workers whose firms go bust without enough funds to pay their pensions.”

He then proceeded to introduce a Bill which dishonoured the pension promises made to the countless people who had had indexation in their company schemes. It seems that he did not understand what he was doing. It further seems that nobody else in the House did either.

Sir John Butterfill, who spoke several times, and was referred to by other members as being deeply knowledgeable on the Bill, said:

“The Bill does not make it clear whether the PPF will have any indexation.”

In this, of course, unfortunately, Sir John was wholly wrong, for Schedule 7 of the Bill made clear (a) that there would be indexation, and (b) that this indexation would be denied to a particular category of people – those with pensionable service prior to 1997.

What is remarkable is not that Sir John was in error, but that neither the Secretary of State, not any other Member, leaped up to correct Sir John and apprise the House of the existence of Schedule 7. One can only conclude that none of them had read it. It seems to have been a case of legislating by ignorance.

The failure in drafting Schedule 7

Can we understand what those who drafted Schedule 7 intended? We are assisted in this by two papers held in the House of Commons Library. A research paper dated 25th February 2004, before the Second Reading, stated that:

“PPF pensions in payment will be indexed in line with the Retail Price index (RPI) capped at 2.5%, but only in respect of rights built up since April 1997 (which is when the statutory obligation to index occupational pensions in payment was introduced).”

This is the linkage previously anticipated, but no justification for it is given, nor any warning of the dire consequences which would follow.

In October 2020, there was a briefing paper on the Act. This presumably took account of deliberations in committee and in the House of Lords. The explanation for the pre-1997 rule as given above was repeated, but then we are told that:

“Restricting the amount of indexation paid on PPF compensation would ensure that the PPF could do that (provide a consistent level of support) by being better able to predict its liabilities and plan ahead financially.”

As a result, promises were dishonoured, and people unfairly deprived, to save money. It doesn’t make one proud to be British. It was not even to save public money, but to help with the internal housekeeping of the PPF.

Our legal fight

Age discrimination

The Pensions Act 2004 established the Pension Protection Fund to right the wrong that pensioners suffered by the loss of their pension when the company and pension fund, to which they may have contributed for all of their working life, went bust. PPF made good some but not necessarily all the loss. The payments to be made by PPF were raised each year for inflation but not for everyone. Para 28 of Schedule 7 to the Pensions Act 2004 provides that payments made by PPF for pensionable service prior to 6 April 1997 is not indexed. Its effect is to discriminate against people on the basis of their age. Discrimination, in law, does not depend on intent. If the effect of a policy is discriminatory then, legally, that can amount to discrimination. This is what we have in the present case.

If everybody under 40 has an entitlement to indexation, people over that age get progressively less indexation, and there are 60,000 people over 80 with zero indexation, it looks, smells and tastes like age discrimination.

The primacy of Parliament

The Pensions Act is an Act of Parliament and thus a prime statute passed by Parliament. Under the British constitution Parliament is supreme but that does not mean that it can ride roughshod over human rights without consequences. This is an Act that is basically wrong in its effect on tens of thousands of pensioners. It needs correcting and that is our goal.

Counsel’s advice

As a first step in that process we have taken specialist counsel’s opinion. We cannot, on this site, discuss that advice because it is ‘privileged’, enough to say that Counsel has advised on the legal routes that we might reasonably take to challenge the discrimination in the court. No doubt challenging a primary statute is not straightforward but the prize to be gained in righting this wrong is of huge significance to the pensioners affected.